------------------

------------------ ------------------

------------------ ------------------

------------------

PORTFOLIO VALUE

on Thursday 8th May 2008

$341046

What the portfolio would have been on ......

x

x

Tuesday 24th June 2008

$309243 = down by $31803 since Thursday 8th May

Wednesday 25th June 2008

$301181 = down by $39865 since Thursday 8th May

This would have been the lowest total since 31st March !!

Thursday 26th June 2008

$301205 = down by $39841 since Thursday 8th May

Friday 27th June 2008

$298739 = down by $42307 since Thursday 8th May

This would have been the lowest total since 28th March !!

Monday 30th June 2008

$303460 = down by $37586 since Thursday 8th May

Tuesday 1st July 2008

$305732 = down by $35314 since Thursday 8th May

Wednesday 2nd July 2008

$301017 = down by $40029 since Thursday 8th May

This would have been the lowest total since 31st March !!

Thursday 3rd July 2008

$284023 = down by $57023 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Share plummet wipes $28 billion off market

The share market has closed at its lowest point in nearly two years

as big mining stocks fell and the rising oil price fanned fears of an economic slowdown

At the close, the benchmark S&P/ASX200 index had lost 96.5 points, or 1.89 per cent, to 4998.3

The decline wiped $28.7 billion off the value of the broader market

The index closed under 5000 points for the first time since September 2006, when it ended at 4983.2

"There's blood on the floor and on the walls" Austock senior client adviser Michael Heffernan said

"Resources stocks were carved up mercilessly"

The S&P/ASX200 also recorded its biggest one-day fall since June 12, when the index lost 2.3 per cent

The broader All Ordinaries fell 117.6 points, or 2.26 per cent, to 5,094.0,

its worst closing level since September 2006 when it ended at 4948.4

The S&P/ASX200 touched an intraday low of 4969.1 while the All Ords went as low as 5069.4

In the local gold sector, Newcrest fell $1.01 to $30.00 after closing out its gold hedge book at a cost of $1.67 billion

Coal stocks, which had enjoyed a stellar run, had suffered from a drop in the spot price of coal and profit-taking by investors

With the resources, BHP Billiton lost $3.07, or 7.16 per cent, to $39.82, and Rio Tinto dumped $10.36, or 7.83 per cent, to $121.95

Friday 4th July 2008

$287011 = down by $54035 since Thursday 8th May

This would have been the lowest total since 20th March !!

Monday 7th July 2008

$279622 = down by $61424 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Local stocks fall but close above 5000

Australian stocks fell sharply today and at one stage dipped back below 5000 after weakness in miners, banks and property trusts

In the tight grip of a bear market, the benchmark S&P/ASX 200 Index closed down 79.6 points, or 1.57 per cent, at 5002.5 today

It fell below the 5000 mark last week for the first time in almost two years, slipping as low as 4969.1

The broader All Ordinaries was down 78.3 points, or 1.51 per cent, at 5091.7 today

The big miners were down following mixed base metal prices in London late last week

and concerns about the risk of higher interest rates slowing demand in China

Global miner BHP Billiton fell 95 cents to $39.75 and Rio Tinto lost $2.45 to $123.25

In the gold sector, Newmont was off one cent to $5.16, Newcrest was down $1.66 to $28.32 and Lihir weakened eight cents to $3.06

The price of gold in Sydney was $US923.65 per fine ounce, down $US10.65 on Friday's close of $US934.30

Tuesday 8th July 2008

$276637 = down by $64409 since Thursday 8th May

This would have been the lowest total since 22nd January !!

ASX lower after falls in financials

The Australian stock market closed at its lowest levels since August 2006 after falls from the financial sector dragged the market down

The benchmark S&P/ASX200 index was 69.6 points, or 1.39 per cent, lower at 4932.9,

while the broader All Ordinaries lost 69.3 points, or 1.36 per cent, to 5022.4

The market got off to a poor start following a weak lead from Wall Street overnight,

with the Dow Jones Industrial Average falling 56.58 points to close at 11,231.96

The big miners were mixed, with Rio Tinto gaining 20 cents to $123.45 and rival BHP Billiton losing 25 cents to $39.50

The spot price of gold was higher

and was trading at $US930.10 an ounce, up $US6.80 on yesterday's local close of $US923.30 an ounce

The gold miners were weaker, with Newcrest falling 68 cents to $27.64, Lihir dropping four cents to $3.02

and Newmont shedding eight cents to $5.08

Wednesday 9th July 2008

$283162 = down by $57884 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Thursday 10th July 2008

$280395 = down by $60651 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Friday 11th July 2008

$288811 = down by $52235 since Thursday 8th May

Monday 14th July 2008

$286427 = down by $54619 since Thursday 8th May

This would have been the lowest total since 20th March !!

Tuesday 15th July 2008

$283448 = down by $57598 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Wednesday 16th July 2008

$283246 = down by $57800 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Thursday 17th July 2008

$280059 = down by $60987 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Friday 18th July 2008

$279127 = down by $61919 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Aussie stocks down

The Australian share market closed in the red despite a firmer Wall Street,

with resources stocks dragging the market down and bank shares continuing to see-saw

The benchmark S&P/ASX200 index shed 60.6 points or 1.24 per cent to 4,840.4,

while the broader All Ordinaries dropped 62.1 points or 1.25 per cent to 4,915.3

The benchmark index fell 2.8 percent on the week to post its ninth straight week of declines,

the longest such losing streak since a ten-week decline between May and July 2002

The index has now lost almost 24 percent since the start of the year after an 11.8 percent gain in 2007

Austock Securities senior client adviser Michael Heffernan said the gloom on the market defied logic because the price of key

commodities such as aluminium, zinc, nickel and copper were higher, although the oil price had come off recent historic highs

"I think the emissions trading scheme (ETS) is sending shivers through the spines of industrial companies" Mr Heffernan said

"But this is knee- jerking stuff"

He said the market had responded pessimistically this week to "respectable reports" from Centro, Nufarm, Woodside and Rio Tinto

Woodside chief Don Voelte was today reported as saying that more than $60 billion of planned liquefied natural gas investments

could be shelved because of the ETS

Woodside fell $3.00, or 5.13 per cent, to $55.50, which Mr Heffernan described as a "bargain price for a quality stock"

Takeover target Rio Tinto fell $2.50 to $115.50

and suitor BHP Billiton shed 90 cents or 2.4 per cent to $36.65, its lowest close since early April

The spot gold in Sydney was US960.10, down $US3.80 per fine ounce from yesterday's close of $US963.90

The gold miners were mixed

Newcrest edged one cent higher to $32.21, Lihir Gold fell 14 cents to $3.02 and Newmont Mining dropped 18 cents to $4.95

CSL Ltd, the world's top maker of plasma products, outperformed today closing up $2.05 or 5.9 percent to $37.05

Analysts said stronger-than-expected earnings and a profit upgrade at US competitor Baxter International Inc augurs well for CSL,

which has similar earnings drivers

**!! Just by the way ... ANZ Bank slid 18 cents to $18.21 ... was down to $17.12 on the Tuesday 15th July !!**

Monday 21st July 2008

$284692 = down by $56354 since Thursday 8th May

Tuesday 22nd July 2008

$282426 = down by $58620 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Wednesday 23rd July 2008

$282824 = down by $58222 since Thursday 8th May

This would have been the lowest total since 22nd January !!

Thursday 24th July 2008

$279307 = down by $61739 since Thursday 8th May

This would have been the lowest total since 22nd January !!

ASX higher, driven by financials

The Australian share market closed in the black again on Thursday, driven by a stronger financial sector,

but weaker resource stocks capped the bourse's gains

The benchmark S&P/ASX200 index was up 38.8 points or 0.76 per cent to 5,144.1,

while the broader All Ordinaries gained 26.8 points or 0.52 per cent, to 5,188.4

CommSec market analyst Elvina Simpson said the financial sector was up more than three per cent,

adding to Wednesday's 5.5 per cent gains in the sector

Ms Simpson said weaker commodity prices had dragged down resource stocks

Mining giant BHP Billiton shed $1.13 to $37.55 while its rival and takeover target Rio Tinto dropped $4.90 to $115.20

She said the energy sector was hit hard overnight by a three per cent drop in the oil price to a six-week low of $US124.44 a barrel

Gold was trading at $US923.90 per fine ounce in Sydney, down $US14.15 from Wednesday's close of $US938.05

"Gold stocks were heavily sold off after the gold price fell" Ms Simpson said

Lihir dipped 15 cents, or 5.03 per cent, to $2.83, Newmont shed 21 cents to $4.84 and Sino Gold lost 29 cents to $5.67

Newcrest said its production for 2008 rose to a record 1.781 million ounces, up 10.14 per cent from 1.62 million ounces in fiscal 2007

However, Ms Simpson said Newcrest was not helped by a six per cent fall in fourth quarter production,

sending its shares down $1.72, or 5.53 per cent, to $229.40

Friday 25th July 2008

$274308 = down by $66738 since Thursday 8th May

This would have been the lowest total since 22nd January !!

NOTE - back on the 22nd January 2008 this portfolio was valued at $273964, and this was the

lowest total since I started recording individual daily totals on the 5th November 2007

Today's total of $274308 is just $344 higher than this all-time-low value !!

... and the 5th November was over eight months ago !!

Stocks close 3% weaker on Friday

The Australian share market had its largest one-day fall in six months, closing more than three per cent weaker and wiping $38.5 billion

from its value, on troubling news from National Australia Bank (NAB) and a weak lead overnight from Wall Street

The benchmark S&P/ASX200 index finished down 173.6 points, or 3.37 per cent, to 4,970.5 after hitting a low of 4,939.8 in intraday

trade

The broader All Ordinaries shed 157.4 points, or 3.03 per cent, to 5,031 after reaching a low of 5,003.2 in early trade

It was the biggest one-day fall since January 22 when the All Ords fell 7.3 per cent and the S&P ASX 200 fell 7.1 per cent

NAB shares finished 13.49 per cent down it reported further provisional losses related to its exposure to complex US mortgage-backed

debt securities, closing down $4.14 to $26.56 after sinking to an intraday low of $26.22

The bank said it had made a provision of $830 million on its exposure to a portfolio of collateralised debt obligations, building on a

$181 million charge booked in its first half

More than 38 million NAB shares changed hands today

CMC Markets senior dealer James Foulsham said it had been a brutal day across the board

"The NAB news coupled with the fact that the US market was off nearly 300 points has absolutely smashed the local market"

Mr Foulsham said

"We've seen a lot of mixed selling of NAB: we've seen people selling out of longs because they are concerned NAB might have a

skeleton in the closet and some people were thinking it was an overreaction and were buying into the stock

"At this stage, it is a provision, not a write-off

But people's concern is that there is worse to come and that the bank could have some substantial losses that they are foreshadowing

The other possibility is that this is only the first stage of their provisions and there could be more of this stuff to come

It's had a flow-on effect to the other banks"

Mr Foulsham said the financial sector lost more than six per cent today - "a huge move"

Resources giant BHP Billiton Ltd fell 63 cents to $36.92 while rival and takeover target Rio Tinto lost $1.40 to $113.80 after

commodity prices fell overnight

BHP and energy giant ExxonMobil Corp today said they had given the green light for the $US1.25 billion ($A1.3 billion) Turrum

project in Bass Strait

In other headlines, Rio Tinto subsidiary Energy Resources of Australia Ltd, the world's fourth-largest uranium producer, has reported

a strong rise in first half profit after the uranium price spiked

Spot gold was trading in Sydney at $US934.10 per fine ounce, up $US7.80 from Thursday's close of $US926.30

Among gold producers, Newcrest Mining fell 45 cents to $28.95 and Lihir added 11 cents to $2.94 and Newmont gained 22 cents, or

4.55 per cent to $5.06

Monday 28th July 2008

$277262 = down by $63784 since Thursday 8th May

Stocks close in the red, banks tumble

The Australian stock market has finished the day in the red with the banks tumbling after ANZ Banking Group Ltd forecast its annual

earnings to fall by up to a quarter due to the impact of the global credit crisis

The benchmark S&P/ASX200 index was down 48.4 points, or 0.97 per cent, to 4922.1 while the broader All Ordinaries dipped 39

points, or 0.78 per cent, to 4989.9

CMC Markets dealer Matt Lewis said financial stocks took the brunt of the day's losses, with the sector index down 3.95 four per cent

"Obviously it is a negative start to the week, and really it's the financial sector pulling the market down" he said

"We saw some pre-result commentary by ANZ, and it was negative ... and the other banks have followed suit lower"

ANZ flagged a $1.2 billion second half provision on bad debt and said fiscal 2008 year cash earnings per share were expected to fall by

between 20 and 25 per cent

Its shares dropped $1.94, or 10.93 per cent, to $15.81 - its lowest close since September 2001

It was also its worst one-day fall since October 20, 1987, when the stock lost 8.74 per cent

Mr Lewis said the materials sector was the only bright spot on the day with both BHP Billiton and Rio Tinto gaining

Mining giant BHP grew $1.08 cents, or 2.93 per cent, to $38.00, and Rio Tinto added $4.80, or 4.22 per cent, to $118.60

Gold was trading at $US929.70 per fine ounce in Sydney, down $US3.65 from Friday's local close of $US933.35

Gold producers were mixed with Newcrest adding 63 cents to $29.58, Newmont finding five to $5.11 and Lihir lost two cents to $2.92

!!--Some interesting information on ANZ Bank--!!

These shares are not included in this portfolio as Brett had sold his holding before this set came into affect during October 2007

Through purchases and dividend reinvestments, Brett had 1071 shares in this bank

His total outlay for this holding was $14884.50 ... and the average cost per share was $13.90

He wanted to put his money into other areas, so he sold them on the 17th September 2007 ... and the price was then $28.39 per share

This gave him a total return of $30405.69 ... and an increase of 104.28% on his initial outlay

The ANZ Bank share price increased over the next three weeks, reaching a record high price of $31.55 on the 11th October 2007

Since then, the price initially held, then slid slowly ... and then slid fast to reach the price it is today ... just $15.81 per share !!

If Brett still held his shares and sold them today, the return would have been just $16932.51 or a lousy 13.76% increase !!!

Refer to notes on 29th July, 21st August and 18th and 19th September below

Tuesday 29th July 2008

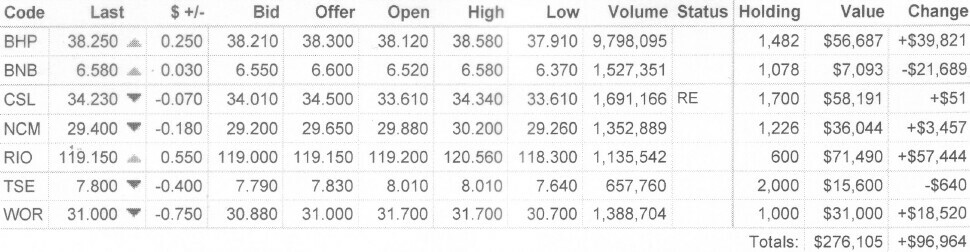

$276105 = down by $64941 since Thursday 8th May

!!--Update on ANZ Bank--!!

The price dropped another twenty-eight cents to finish the day at $15.53

Refer to notes above for more information

Wednesday 30th July 2008

$278470 = down by $62576 since Thursday 8th May